Consistent year on year outsized returns across €1 billion of real estate transactions in Western Europe since 2006

Westcore Europe

Westcore Global & Affiliates

Transacted

Since 2006

Net leasable floor area

Net leasable floor area

Assets Under Management

Current

Europe portfolio

US commercial / residential portfolio

Transacted

Since 2006

Westcore Europe

Net leasable floor area

Westcore Global & Affiliates

Net leasable floor area

Assets Under Management

Current

Westcore Europe

Europe portfolio

Westcore Global & Affiliates

US commercial / residential portfolio

About us

Westcore Europe is an internally capitalized investment management business wholly owned by a $9 Billion USD AUM family office and part of the Westcore Global Group.

We operate local platforms in 5 countries made up of talented practitioners providing local origination and deal flow with best in class asset management.

Westcore partners with other family offices, real estate investment funds, ultra-high net worth individuals and opportunity funds.

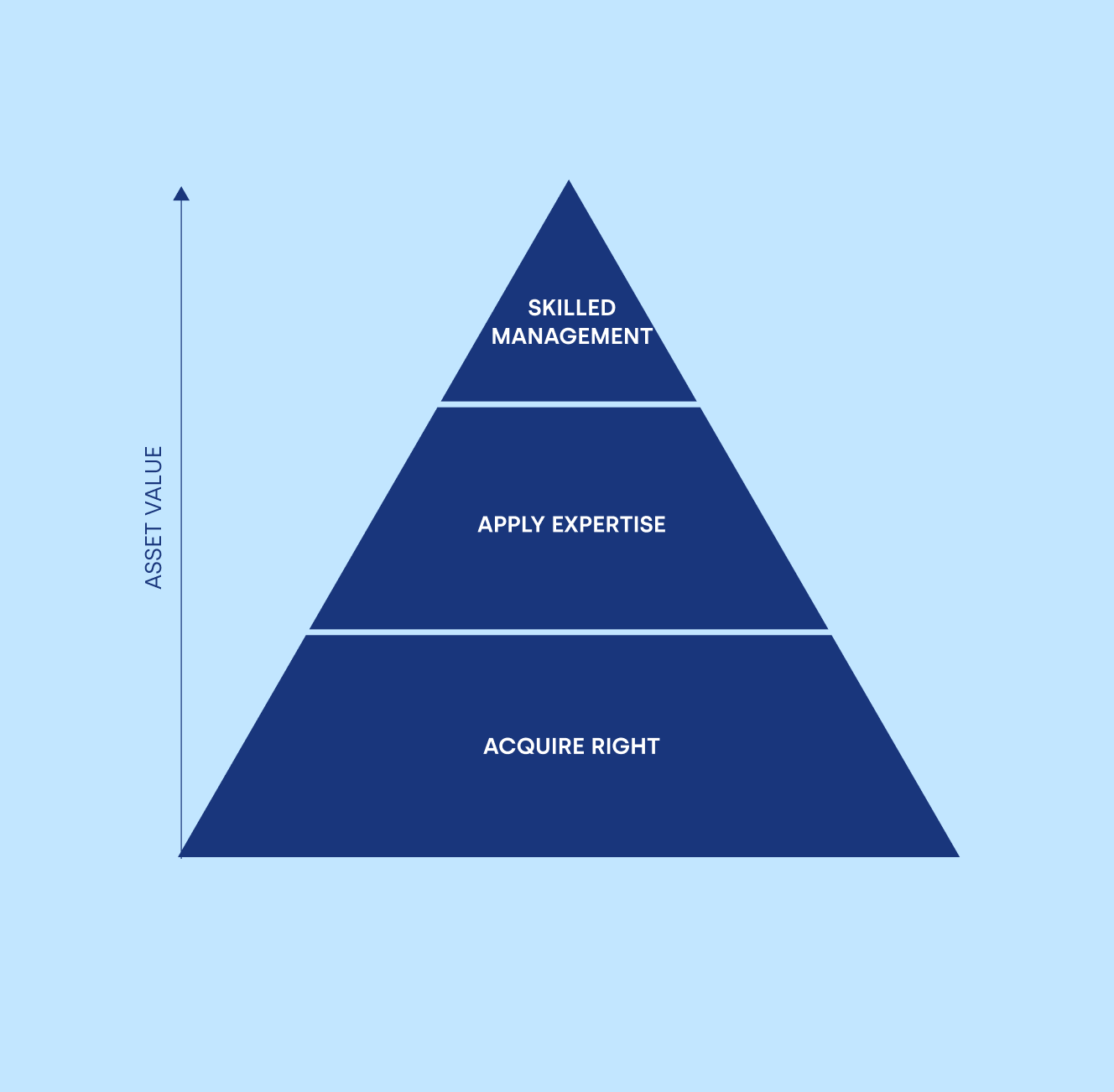

Investment approach

As a lead investor in every deal, we guarantee complete alignment. We favour opportunistic high growth properties where we can inject value-based management expertise to gain outsized returns.